Wednesday, February 28, 2018

How Entrepreneurs Access Capital and Get Funded

https://www.kauffman.org/what-we-do/resources/entrepreneurship-policy-digest/how-entrepreneurs-access-capital-and-get-funded

Craigslist and US Rental Housing Markets

http://geoffboeing.com/2016/08/craigslist-rental-housing-insights/

Long story short: there are incredibly few rental units below fair market rent in the hottest housing markets. This (along with the compression of rents) tells us there might be a big disconnect between housing vouchers and the largest rental housing information exchange (Craigslist). This problem doesn’t exclusively affect the poor: the median household in cities like New York and San Francisco would experience rent burden when paying the median rent.

These national, regional, and local patterns conform to general expectations, yet offer far fresher and finer-grained data. However, Craigslist listings provide advertised rents, not final negotiated rents in legal contracts, and some rental markets like New York’s are dominated by brokers. Craigslist is not representative of the entire housing market: individuals vary in levels of Internet access and technical savvy to list and search for housing online as a function of wealth, employment, education, language, and other socio-demographic traits. Nevertheless, Craigslist presents an invaluable data source for housing research.

Thursday, February 22, 2018

MBTI Flaws

https://www.psychologytoday.com/blog/give-and-take/201309/goodbye-mbti-the-fad-won-t-die

In a Washington Post article, Does it pay to know your type? Lillian Cunningham asks whether we can send the MBTI back to the factory for some refurbishing. The response from Little: “It’s a little bit like taking a Dodge Caravan and trying to turn it into a Rolls Royce.” Instead, psychologists have spent the past half century building a better car from scratch, using the scientific method. That car is called the Big Five personality traits, and it meets the standards above. Across many of the world’s cultures, five personality traits consistently emerge: extraversion, emotional stability, agreeableness, conscientiousness, and openness. The Big Five traits have high reliability and considerable power in predicting job performance and team effectiveness. They even have genetic and biological bases, and researchers in the emerging field of personality neuroscience have begun mapping the Big Five to relevant brain regions.

In a Washington Post article, Does it pay to know your type? Lillian Cunningham asks whether we can send the MBTI back to the factory for some refurbishing. The response from Little: “It’s a little bit like taking a Dodge Caravan and trying to turn it into a Rolls Royce.” Instead, psychologists have spent the past half century building a better car from scratch, using the scientific method. That car is called the Big Five personality traits, and it meets the standards above. Across many of the world’s cultures, five personality traits consistently emerge: extraversion, emotional stability, agreeableness, conscientiousness, and openness. The Big Five traits have high reliability and considerable power in predicting job performance and team effectiveness. They even have genetic and biological bases, and researchers in the emerging field of personality neuroscience have begun mapping the Big Five to relevant brain regions.

Saturday, February 17, 2018

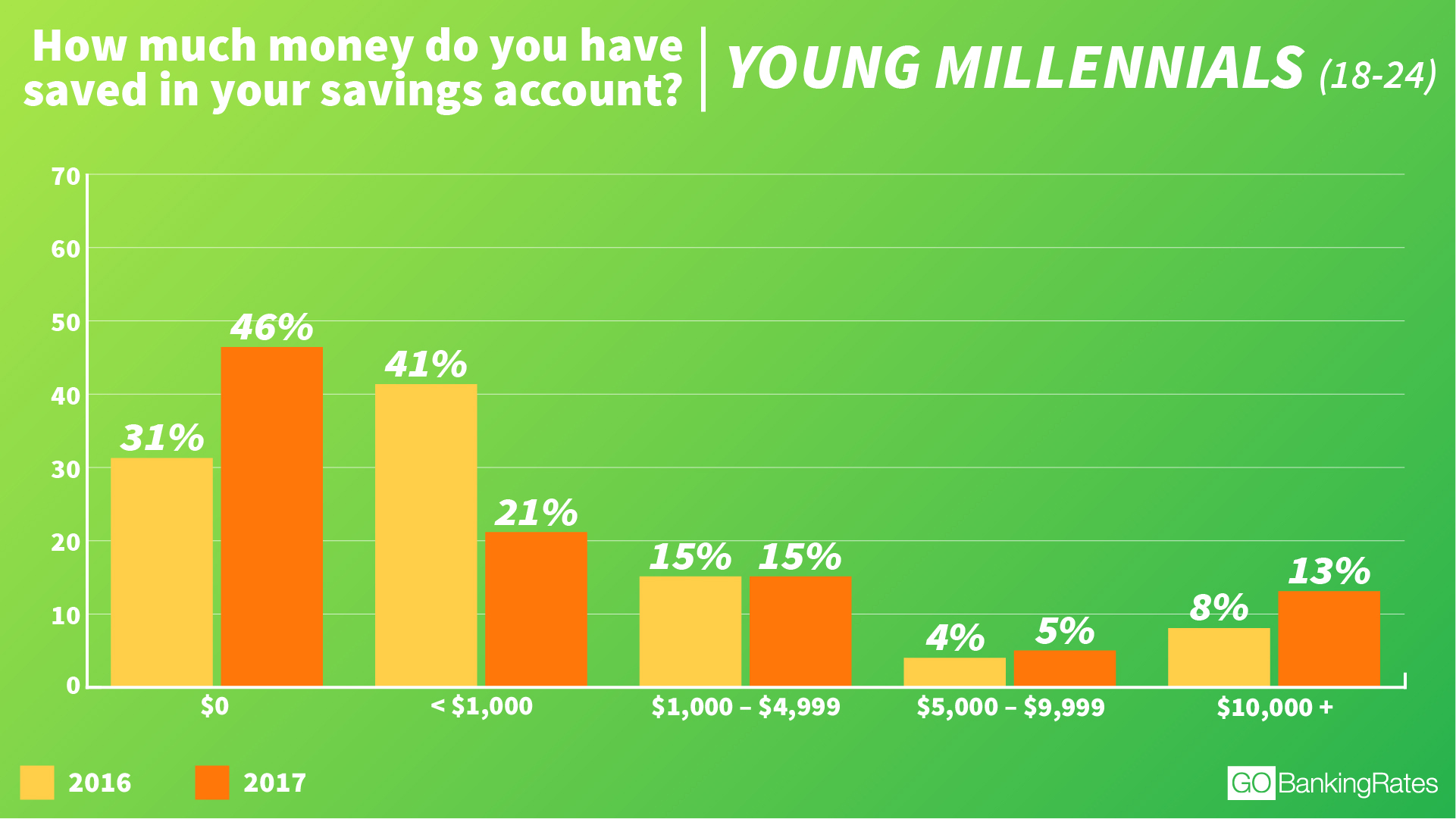

Millennial Savings

https://www.cnbc.com/2017/09/14/how-much-money-the-average-millennial-has-in-savings.html

Of "young millennials" — which GOBankingRates defines as those between 18 and 24 years old — 67 percent have less than $1,000 in their savings accounts and 46 percent have $0.

While an alarming amount of young people have little to no savings, "on the other end of the spectrum, some millennials seem to be taking steps to increase their savings account balances," the site reports. "From 2016 to 2017, the percentage of younger millennials who have $10,000 or more in a savings account has jumped five percentage points."

Here's the percentage of the survey respondents aged 18 to 24 who have:

$0 saved: 46 percent

Less than $1,000 saved: 21 percent

$1,000 to $4,999 saved: 15 percent

$5,000 to $9,999 saved: 5 percent

$10,000 or more saved: 13 percent

Less than $1,000 saved: 21 percent

$1,000 to $4,999 saved: 15 percent

$5,000 to $9,999 saved: 5 percent

$10,000 or more saved: 13 percent

As for "older millennials" — defined as those between 25 and 34 — the trends are similar: 61 percent have less than $1,000 in their savings accounts and 41 percent have nothing at all:

Subscribe to:

Comments (Atom)